El Cerrito offers a lot to the first-time home buyer; good schools, friendly neighborhoods, great housing stock, two BART stops and a location convenient to the best of the Bay (as long as you time your trip on 80 right!). It also offers a microcosm of what buyers are finding as they shop throughout the East Bay – the forces at play in the region are easily evident here as well.

Why is Everything Going Over List Price?

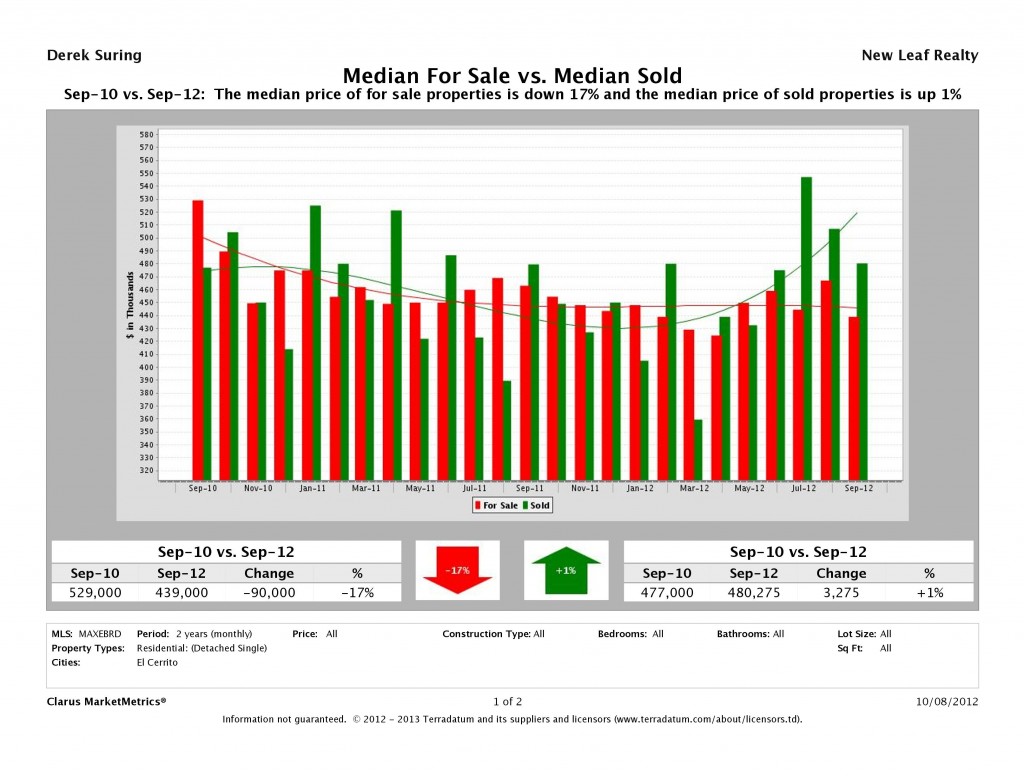

A look at historical Median List and Sold Prices over the last two years shows you graphically what many buyers are feeling. With an average of five offers on every home, the gap between list price and sold price is widening fast.

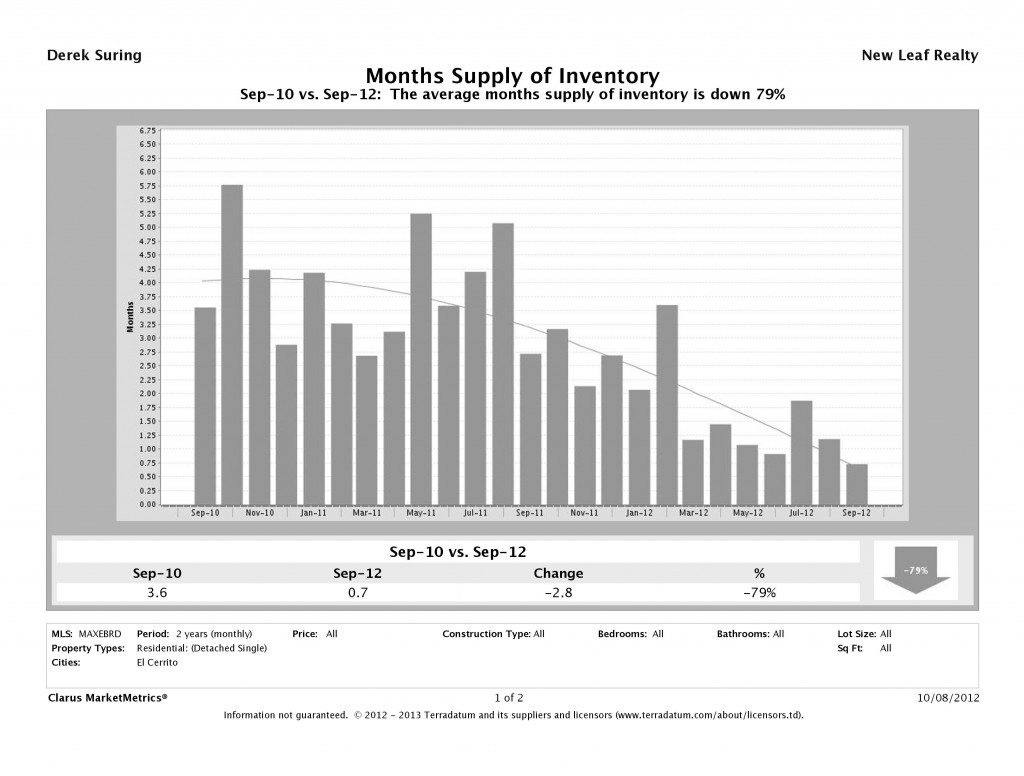

A look at Month’s Supply of Inventory, that is, how many months it would take to sell all of the homes on the market if no new ones were added is even more dramatic. Five months of inventory is considered healthy, we are currently lucky to see one.

The usual suspects are driving this trend:

- Buyers have realized the price declines are at an end and we are seeing the market pick back up again, everyone who was sitting on the fence is now actively shopping.

- Lending standards and interest rates continue to drop, giving every Buyer more potential purchasing power.

- Other asset classes, such as commodities, bonds and equities continue to show little sign of promise.

- The supply of distressed property has tailed off, creating a shortage of homes for sale.

- Potential Sellers who have been waiting to put their property on the market for the last few years are now getting closer, but see the price increases occurring and can consider holding off for just a little while more to see if this trend continues.

What’s Going to Happen Next?

Barring a major economic shock, I think it is safe to say that the number of distressed properties coming on the market will continue to wane. Here’s a look at foreclosure inventory in the area, each segment is dropping fast.

Interest rates will continue to hold steady so it will continue to be a great time to buy. The wildcard is how long Sellers will hold out before they put their homes on the market and inventory returns to normal levels. Sellers waiting for a prolonged rise in value before they sell are not going to see their hopes materialize. Buyers are unable to borrow more than their incomes can support, and incomes are not rising that quickly across the Bay Area. Thus I expect we’ll see a market plateau with many Buyers offering no means of support to continued price increases.

Eventually, as more Sellers realize that housing will more or less now correlate closer to inflation and GDP growth, they will resume the normal cycle of up and downsizing that was prevalent before the bubble and the downturn. Our inventories will slowly start to rise and total sales will pick up. Multiple offers will be the norm, but paying attention to terms will become even more important in a crowded field with similar pricing power.