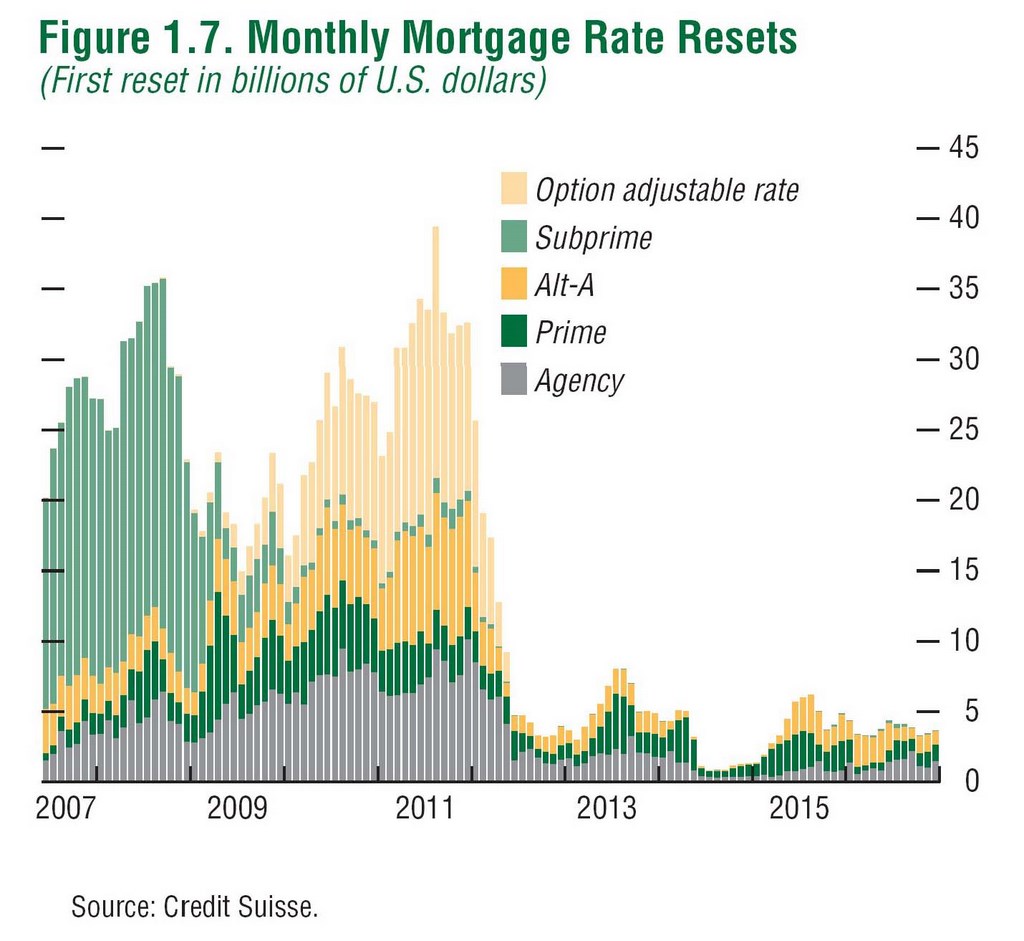

The question we are asked most frequently is, of course, when will prices begin to rise again? The answer is tangled up in a knot of mortgage rates, unemployment levels, regulatory action and availability of new building supply. We like to use the following graph to get back to the basics of what caused the crash in the first place. It illustrates rather sharply the incredible wave of adjustable rate mortgages resetting to higher rates month by month. At their peak of popularity, ARMs made up almost half of the entire mortgage market. These ARMs often contained low “teaser” rates which are now resetting to market conditions. Others were based on interest-only until a fixed point at which they converted to fully amortizing loans (a loan in which principle as well as interest is due monthly). These resets caused “payment shock” in which the owners were unable to cover the full cost of the mortgage and were forced to seek alternative solutions including loan modifications, a short sale or foreclosure. These forced sales then dominated the market and build up large amounts of inventory which are still holding prices back.

As the graph demonstrates, the subprime mortgages which initially created all of the trouble stopped resetting back in 2009. These are the foreclosures that our clients were buying in 2010. The Alt-A and Option ARMs are now the culprits; their resets will dramatically tail off in early 2012. The inventory created by these forced sales will most likely hang over the market for at least 2012 and most likely well into 2013. Only once we are able to absorb this inventory will prices be able to recover from their current levels (which are more or less the same as they were in the year 2000). The one bright spot about the second wave of resets is that current interest rate policy is holding the indexes so low that some of them may be resetting at rates lower than current. While this may curtail continued forced selling, we have more than enough inventory in the pipeline to make this a fantastic buyer’s market. Being able to purchase when both rates and prices are this low in tandem is a rare occurrence.