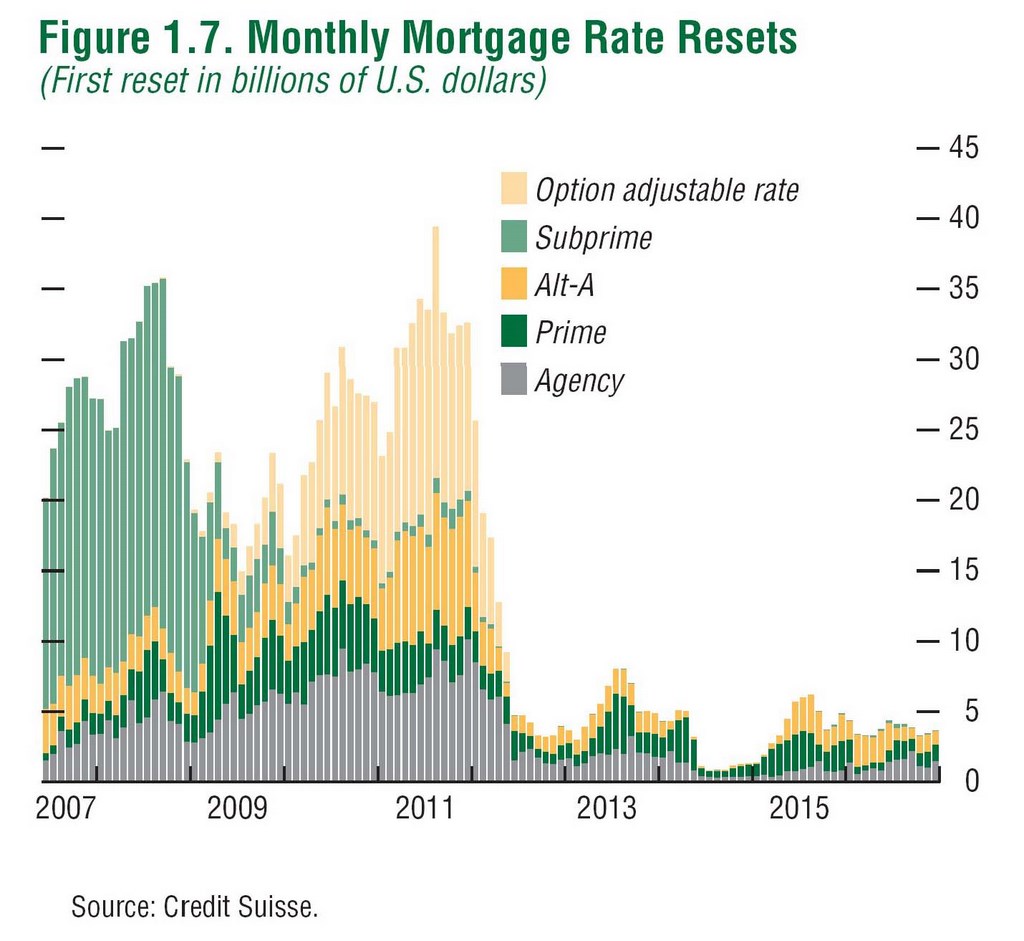

The question we are asked most frequently is, of course, when will prices begin to rise again? The answer is tangled up in a knot of mortgage rates, unemployment levels, regulatory action and availability of new building supply. We like to use the following graph to get back to the basics of what caused the crash in the first place. It illustrates rather sharply the incredible wave of adjustable rate mortgages resetting to higher rates month by month. At their peak of popularity, ARMs made up almost half of the entire mortgage market. These ARMs often contained low “teaser” rates which are now resetting to market conditions. Others were based on interest-only until a fixed point at which they converted to fully amortizing loans (a loan in which principle as well as interest is due monthly). These resets caused “payment shock” in which the owners were unable to cover the full cost of the mortgage and were forced to seek alternative solutions including loan modifications, a short sale or foreclosure. These forced sales then dominated the market and build up large amounts of inventory which are still holding prices back.

As the graph demonstrates, the subprime mortgages which initially created all of the trouble stopped resetting back in 2009. These are the foreclosures that our clients were buying in 2010. The Alt-A and Option ARMs are now the culprits; their resets will dramatically tail off in early 2012. The inventory created by these forced sales will most likely hang over the market for at least 2012 and most likely well into 2013. Only once we are able to absorb this inventory will prices be able to recover from their current levels (which are more or less the same as they were in the year 2000). The one bright spot about the second wave of resets is that current interest rate policy is holding the indexes so low that some of them may be resetting at rates lower than current. While this may curtail continued forced selling, we have more than enough inventory in the pipeline to make this a fantastic buyer’s market. Being able to purchase when both rates and prices are this low in tandem is a rare occurrence.

I just ran across this wonderful chart in the latest John Mauldin newsletter (www.johnmauldin.com). It brought to mind a conversation I had with a a friend at a birthday party in SF earlier today. US GDP is finally picking up and looks likely to be able to maintain a 3% increase year on year for some time. Not particularly exciting from a investor’s standpoint but solid enough to provide jobs to a growing population…but not enough to put a dent in our unemployment rate as we have millions of lost jobs that need to be recreated. As it stands, the only factor that can possibly bring down our unemployment rate absent a substantial increase in GDP is people leaving the labor force.

If you haven’t looked for work in the last four weeks you are absent from the labor force; you are not counted as unemployed. The major factor contributing to the decrease in the unemployment rate has been a drop in the number of those who are actively seeking work. We are sliding back to a level of participation in the workforce not seen since 1980.

Given that Americans since the 1970s have had to increase the number of family members working, e.g. both spouses working full time, this may not be as bad as most pundits have made it out to seem. Average wages per household have grown far behind inflation for some time; perhaps a a sustained bout of deflation and especially a reduction in housing costs as we are seeing played out across the Bay Area might make not economic sense, but contribute mightily to quality of life. Were we actually much better off over the last three decades with 65% of the population in the workforce, or is a level below 60% completely in keeping with a wonderful life? I’ll need to look to those more elder than I for the anecdotal response.

Ancient Greek history appears in plaster cast form at Cal

February 16, 2011 11:15 am by Tracey Taylor

One of the Parthenon Frieze panels in Dwinelle Hall on the UC Berkeley campus. Photos: Tracey Taylor.

You no longer need to travel to the British Museum in London, or to Athens, to see at least some of the creative wonders of the Parthenon.

Last weekend saw the installation on the UC Berkeley campus of a series of plaster cast panels of the Parthenon Frieze in the main lobby of Dwinelle Hall, which houses the university’s Classics department.

According to the Classics department, in the late 19th and early 20th century it was common for universities in Europe and the U.S. to acquire plaster casts of famous Greek and Roman sculptures. These were exhibited to help students of ancient art, fine arts and art practice, since, in the Beaux Arts tradition, study and drawing of masterworks of the past were strong components of the curriculum.

UC Berkeley had such a teaching collection, but with the changes in 20th-century art and art education it ceased to be used and was placed in storage. With some effort, Emeritus Professor Stephen Miller located the casts, many of which were stored in unsuitable conditions. The original owners of the Parthenon frieze is the Fine Arts Museums of San Francisco.

Professor Miller worked to get the university’s cast collection protected from further damage and eventually was able to lead a couple of graduate classes in study and restoration of a limited number of the important pieces.

For more information on the casts collection visit UC Berkeley’s Casts website.

via Ancient Greek history appears in plaster cast form at Cal | Berkeleyside.

A review of mortgage-servicing practices by U.S. regulators found serious problems with internal controls and staffing levels at the companies, which are likely to result in formal enforcement action against more than a dozen major financial institutions, according to people familiar with the situation.

The penalties against Bank of America Corp., J.P. Morgan Chase & Co., Wells Fargo & Co. and 11 other home-loan servicers being investigated since last fall over breakdowns in procedures for payment collection, loan modifications and foreclosures could include fines and changes in how the companies operate, these people said.

While regulators haven’t agreed on exact details of the punishment, some banks could be notified within days of the enforcement action being taken against them.

In testimony prepared for a Senate Banking Committee hearing Thursday, John Walsh, acting head of the Office of the Comptroller of the Currency, which oversees most of the nation’s biggest banks, said the probe found “critical deficiencies and shortcomings” in document procedures, oversight of outside law firms and other areas.

“By emphasizing timeliness and cost efficiency over quality and accuracy, examined institutions fostered an operational environment that is not consistent with conducting foreclosure processes in a safe and sound manner,” Mr. Walsh said in his remarks. The problems violated state laws and had “an adverse affect on the functioning of mortgage markets and the U.S. economy as a whole.”

A review of 2,800 foreclosures also uncovered a “small number” of wrongful sales that shouldn’t have occurred, since the borrowers were on military deployment, filed for bankruptcy-court protection shortly before the foreclosure or had been approved for a trial loan modification, Mr. Walsh said.

Loan-servicing firms are likely to cite the outcome as proof of their insistence since the robo-signing mess erupted last fall that paperwork problems haven’t caused an epidemic of mistaken foreclosures. Still, the penalties and operational changes being imposed by regulators will be embarrassing and expensive. Regulators want to “get closure on this pretty quickly,” said one person familiar with the discussions.

State attorneys general say their investigation of foreclosure practices is entering a critical phase. Iowa Attorney General Tom Miller, who is heading the multistate investigation, said in a statement that the states “are making every effort to work with these federal agencies in hopes of a coordinated settlement.” But Mr. Miller added that many of the bank practices under review are violations of state law. Regardless of any federal action, the states “intend to fully pursue all state claims and remedies,” he said.

The wide swath of U.S. agencies that has been scrutinizing mortgage servicers or involved in meetings with industry officials also includes the Justice Department, Department of Housing and Urban Development, Federal Housing Finance Agency and newly formed Bureau of Consumer Financial Protection.

Banking regulators’ specific enforcement actions wouldn’t preclude, and could be one part of, the broader settlement this group may pursue against banks.

Last week, Federal Reserve Governor Sarah Bloom Raskin said preliminary results of the review “indicate that widespread weaknesses exist in the servicing industry.” The problems “pose significant risk to mortgage servicing and foreclosure processes, impair the functioning of mortgage markets, and diminish overall accountability to homeowners,” she added.

Bank of America, J.P. Morgan and Wells Fargo declined to comment.

In addition to fines, federal regulators have been considering new rules aimed at correcting what U.S. officials have concluded are deficiencies in how borrowers are treated during the loan-modification process. The requirements could include a code of conduct for home-loan servicers, a “single point of contact” for troubled borrowers and procedures for how banks handle loan modifications and foreclosures simultaneously.

People involved in the talks cautioned that no agreement has been reached, partly because of differences between various agencies about the size of penalties and the scope of procedural changes that are needed.

OCC officials have proposed relatively modest fines, according to people familiar with the situation. Officials from the Bureau of Consumer Financial Protection and FDIC have pushed for larger penalties that could include compensation for borrowers or forcing mortgage servicers to consider reducing loan balances, these people said.

U.S. officials are trying to make sure that the forthcoming enforcement actions by federal banking regulators don’t give servicers any wiggle room to resist additional punishment by U.S. or state regulators by arguing that the servicers already satisfied their primary banking regulator’s demands.

via Big Banks Face Fines on Role of Mortgage Servicers – WSJ.com.

We’re seeing a shift in the way our clients view their daily living – suburbs and hillsides are becoming less sought after and walkable commercial districts with mass transit have held their value well (check out the rising popularity of websites such as walkscore.com!). These demand changes, along with demographic fluctuations and the story regarding oil pricing below are sure to influence where houses prices will be over the next decade. The importance of local knowledge and a grasp of urban development have never been more crucial for your purchase decisions.

-Derek

The oil market breathed a small sigh of relief Friday after Hosni Mubarak resigned as president of Egypt, sending prices to a 10-week low. But Charles T. Maxwell, an analyst who’s been toiling in the energy business since 1957, all but shrugged off the toppling of the dictator. He’s sticking with a bold prediction: Prices will climb to $300 a barrel in 2020, or about $225 in today’s dollars. The world simply won’t have enough oil to meet demand, he says. Barron’s interviewed Maxwell, 79 years old, by telephone from the Greenwich, Conn., offices of Weeden & Co.

Barron’s: How will Hosni Mubarak’s removal from power and Egypt’s political unrest affect the global oil market?

Maxwell: Even though Egypt is an oil producer, it is a small one, producing a little bit less than 1% of the world’s total. But what is so critical is that roughly 30% of the Arabs in North Africa and the Middle East live in Egypt. So it is terribly important as a population center, and also as the center of publishing, education, medicine, technology and manufacturing in that region. In so many different ways, Egypt represents leadership in various civilized activities in the Arab world, and in keeping the peace in the Middle East, thanks to 30-plus years of agreements between the Egyptian state and Israel. It’s been critical to keeping the Middle East stable. So it is in this wider context that Egypt is so important, should its government change over to, say, an Islamist party like the Muslim Brotherhood, and should it in some way begin to default on the diplomatic agreements it has already made.

There’s been a lot of talk about the Suez Canal. Is it still significant in shipping oil?

It isn’t as important these days. It was very critical in the famous days of the past. These days, the Suez-Mediterranean pipeline does about 1.1 million barrels a day, and the canal itself does about 1.9 million. So putting them together, that’s three million barrels a day out of a total of about 88 million barrels around the world every day. So we are looking at about 3.5% of world production. If the Suez Canal were cut off, we could easily get over the problem, but we would have to pay more to carry it around the bottom of Africa, with an extra 12 days on the ocean. I don’t think the Suez Canal will be shut down, but if that were to happen, it wouldn’t be a disaster.

Oil prices have moved a lot higher lately. West Texas Intermediate, for example, is at around $87 a barrel, versus a shade over $71 last August. What’s driving that increase?

There are various reasons given for that, including the economic recovery, which is requiring more crude oil. Another reason would be that Russia had been increasing its production, until just recently, to about 10.2 million barrels a day. But currently they aren’t expanding any further, and Russia’s oil production will probably be flat or a little down. So that contribution appears to be over for the moment, not for the longer term. And the political problems in Nigeria are coming back. But I think these reasons for the recent spike in oil prices pale in comparison to the true long-term cause, which is that demand for oil continues to rise from greater economic activity around the world. Societies that are modernizing are using more oil for cars, trucks, airplanes and boats and, suddenly, we are back on that growth-of-demand upward ramp. It is pretty obvious to analysts and to the general public that oil companies are straining to get more oil to meet the world’s needs. And the question behind it, of course, is this: In three or four years, will the ability to produce the extra barrels needed be met? The answer is increasingly a question mark, and that pushes higher and higher the present values of the oil in the ground and the desire of holders of oil to add to their supplies.

What’s the current capacity for global oil production?

We are producing about 87 million to 88 million barrels a day, and I would put global capacity at another five million barrels on top of that. So our capacity is about 92 million to 93 million barrels a day, and I see our capacity as reaching perhaps as much as 95 million barrels a day at the peak in about four or five years, probably around 2015. But I think production will go very modestly above that point, if at all, and, in effect, we will reach a plateau. It will be a little bumpy in 2015, 2016, 2017 and 2018. But by 2020, the first signs will become very evident that we can’t go any higher than that in production. So we will begin to settle very slowly and gradually in a world in which we need more oil each year, but we can’t get more.

How high will the price of oil go?

By 2020, I’m looking for about $300 a barrel, which is closer to $225 a barrel in today’s dollars. So it reaches a production plateau around 2015 or 2016 and stays flattish on a bumpy plateau until about 2020, at which point output starts to recede slowly.

What about the impact of increasing production?

Let’s say you increase production by half a percent. But if your demand is up by 1½%, you still don’t have enough to meet your full demand, so then prices have to step in to ration supplies and, in effect, destroy the incremental production by making 1% of the use [too expensive] for those people who can’t afford it.

via Whatever Happens in Egypt, Oil Will Hit $300 by 2020 – Barrons.com.

America’s bastion of capitalism can’t get enough of government support. What Wall Street really cares about when it comes to the Obama administration’s housing-finance proposals, expected Friday, is that Uncle Sam continues to guarantee the bulk of the country’s new mortgages.

The rest is just details. Important ones, to be sure, especially as they relate to the shape and size of Fannie Mae and Freddie Mac, as well as the cost of mortgages. But the central question revolves around whether government should explicitly back mortgages.

Sadly, the administration’s proposals aren’t likely to tackle that issue head on, even if they are painted as long-term moves to wind down Fannie and Freddie. The ostensible reason is that any transition away from government support, unless taken super slow, would further depress housing and choke off the economic recovery. Currently, Fannie, Freddie and agencies like the Federal Housing Administration guarantee more than 90% of all new mortgages.

But there is a deeper reluctance to upset the postcrisis status quo. Markets favor a world in which government takes on most, if not all, mortgage credit risk while investors deal only with things like interest-rate risk. While there is much ire directed at Fannie and Freddie, “many groups benefited from the existing system and want to see a version of it remain,” Jaret Seiberg, an analyst at MF Global, noted in a report this week.

For taxpayers, however, this makes little sense. They get stuck with a potentially huge bill while supporting investors who should be in the business of assessing credit risk. If changing that means mortgages grow more expensive over time, it would at least remove the temptation for politicians to use mortgages as an instrument of policy and ensure that house prices remain more in line with fundamentals. The trouble is, without a hard deadline for change, even if years out, markets will likely defeat any attempt to remove guarantees.

So what will the administration propose? The Treasury Department is expected to put forward three proposals, one in which the government would exit from the housing-finance market, another in which there is more limited involvement and a third that more closely mirrors the current backing afforded through Fannie and Freddie. But this isn’t likely to result in any drastic change to the overarching structure of mortgage markets for some time, notes FTN analyst Jim Vogel.

Granted, there may be incremental changes. Analysts at Goldman Sachs say these could include efforts to reduce the size of loans that can be backed by Fannie and Freddie, reduce the size of the mortgage giants’ balance sheets and increase the fees they charge to guarantee mortgages.

Those are all good steps. But without a long-term commitment to stop subsidizing and distorting housing markets, they will fall short.

There’s a new DIY trend afoot in the world of coffee lovers. They’re roasting their own coffee beans — at home.

It’s not just java pros like Tim VanDragt, a 28-year-old barista at Berkeley’s Local 123 coffeehouse, either. Regular Joes are getting in on the cuppa joe action too. Home roasting classes are popping up in Los Angeles, Washington, D.C., and Portland, where they’ve proven so popular, the Mr. Green Beans coffee store holds weekly roasting workshops. And in Berkeley, a recent Slow Food-sponsored home roasting class sold out so quickly, the group is offering an encore later this month, with VanDragt in the teacher’s seat.

Home coffee roasting is a simple process, VanDragt says. You buy your green coffee beans, plug in your re-purposed air popcorn popper, and wait for the all-important “first crack.” Naturally, we had questions, so we sat down with the self-taught, home roaster to ask.

Q: OK, we’ll bite. A popcorn popper?

A: West Bend Poppery II is the best known. What’s important is that you have side venting, a colander, a fan, some dishes to hold the green coffee beans, a measuring cup, (and) a flashlight to see inside and watch the color of the roast. It’s a very simple process. Watch the coffee.

Q: What are you watching for?

A: Coffee starts off green, then yellow, cinnamon, then progressive stages of brown. If you’ve got a French roast, then black. Chocolaty brown is roughly where you see “first crack.”

Q: First crack?

A: The first crack is kind of the base of everything else. To use one of my favorite analogies, you are control-burning wood. It needs to expand to release pressure. When it expands, it (makes) this popping sound, a very audible, at times, crack — sounds like popping corn. What’s happening is the caramelization of sugars inside the bean. The bean is literally starting to cook. You hear a crack, and there’ll be this arc in flavor and caramelization.

Q: How long does that take?

A: Generally, five minutes for first crack with an air popper. Then two to four minutes to get to a roast. If you wanted something like a French roast, that would take much longer. What I’m working with generally takes eight to 10 minutes.

Q: Any disasters you’d care to share? Ever burned down, say, your kitchen?

A: I melted part of my air popper the very first time I was roasting. I had no idea what I was doing. The popper’s butter tray started to split in half. Turns out, if there’s a tiny little crack, it will expand, because you’re using this longer than an air popper is supposed to be on.

Q: But are the results Starbucks, er, Local 123 quality?

A: You roast at home, you can produce something that is really good.

via The Ultimate DIY: Roasting Your Own Coffee – San Jose Mercury News.

In the “best news I’ve heard recently” category, besides our excellent snow pack, the salmon seem to have returned…

CRESCENT CITY, Calif.—An unexpectedly large run of salmon in the rivers of far Northern California this winter is providing an economic boost to local communities across the hard-hit region.

After years of declining fish numbers, some waterways, including the Smith River—which flows through giant redwoods into the Pacific Ocean near Crescent City—have seen their best salmon returns since the 1970s, according to the California Department of Fish and Game and local biologists.

That is jump-starting the business for guides like Ken Cunningham, who lives near this town of 7,500 and fishes for salmon from a small boat drifting downriver. The 63-year-old said he spent about 20 days guiding last October at the height of the run, compared with about 10 days in October 2009. At $250 to $350 a trip, depending on the number of people, Mr. Cunningham made more than $5,000 in October.

The revival of freshwater recreational fishing is especially important for areas like Crescent City, which 30 years ago was a booming forestry and commercial-fishing town. “It was a very different community. There was a lot of economic activity,” said Richard Young, the Crescent City harbor master and a former commercial fisherman.

In the past 20 years, environmental restrictions curtailed the timber industry, and the trawl-net fishery collapsed, with the local fleet chasing ocean-bottom fish shrinking from 16 boats to four as fishermen like Mr. Young gave up their licenses. Then the ocean-salmon fishery declined, forcing more fishermen to find new work. Many were hired by the maximum-security prison that opened nearby in 1989.

The unemployment rate in Del Norte County, where Crescent City is located, was 13.6% in December, above California’s 12.5% and the national rate of 9.4%.

The new bounty of Chinook salmon began early last fall and stretched through the end of the year, when fish crowded waterways from California’s Central Valley near Sacramento to the coastal streams north of the Oregon border. While exact salmon numbers are scarce, returns of fish born in local hatcheries give an idea of the size of the total run.

The Rowdy Creek Fish Hatchery on a Smith tributary, for one, counted 3,538 salmon this winter, compared with 2,775 last year and 589 in 2006. The nearby Trinity River hatchery’s fall and winter salmon runs totaled 12,002, up from 9,983 a year earlier. To the south, a hatchery on the Feather River reported more than 17,000 returning adult salmon during the recent run, compared with 6,234 a year earlier.

The teeming fish runs are a turnabout from years of decline, when salmon populations were affected by dams, low rainfall and logging, which can smother salmon spawning areas with dirt. Although no one is sure why so many salmon returned this winter, some hatchery managers and others speculate heavy rain and favorable ocean conditions helped the healthy returns.

Scientists say salmon remain imperiled, and that some fish populations in California are extinct or nearing extinction. They are still trying to figure out what makes the populations fluctuate.

What is clear is that this winter’s huge salmon runs have drawn legions of fishermen, creating business for fishing guides, tackle shops and motels in many small towns in the region. The U.S. Fish and Wildlife Service estimated anglers in California made $2.7 billion in fishing-related expenditures in 2006, the most recent year for which data are available.

On remote Smith tributaries, a nonprofit group this winter offered tourists trips to see spawning fish. In drought years, some of those tributaries don’t have enough water for salmon to spawn.

“It’s huge for us to have a big population of fish, for our economy,” said Zack Larson, a local biologist who has also worked as a fishing guide.

At the Hiouchi Motel near prime fishing spots on the Smith, business at the 17-room hotel is up about 15% this winter from last year, said manager Sholia Deroule. “We did have a better season this year,” she said. “The fishermen have been staying around more, and there’s more traffic.”

John Klar, a fishing guide who lives near the coast all winter to be close to the salmon streams, said clients hooked five or six fish each day at the height of the run, twice as many as in recent years. “It’s been a phenomenal run,” he said.

State regulations aim to protect the Smith run from overfishing by limiting anglers to killing one salmon a day, and requiring them to throw back any wild steelhead, a sea-going rainbow trout that draws fishermen to the region.

Still, Andy Van Scoyk, who runs the Rowdy Creek Fish Hatchery, said there was reason for concern. While this winter’s run was large, he said, its small proportion of juvenile fish points to a potentially weak run next winter.

4638 Benevides Ave, Oakland

4638 Benevides Ave, Oakland

A charming bungalow from the street, this Mediterranean gem opens into a cathedral ceiling and full length windows overlooking the wilderness of Sausal Creek. Listed as a 3 bedroom, 2 bath, it also features two decks, skylights, granite and stainless steel in the updated kitchen. Only two blocks from the commercial Park Blvd. Simply great living in the Glenview and very well priced at $645k.

2737 Monticello Ave, Oakland

2737 Monticello Ave, Oakland

We’re seeing some great activity around Maxwell Park right now and this is my current personal favorite. This larger 2 bedroom, 2 bath located in the very heart of the neighborhood has plenty of sunshine and views, a large sunny garden space, enclosed patio, hardwood floors and a fireplace. Just in case, it also has a separate recording studio out back! Listed at $387k.

Annie’s Homegrown leased 33,551 square feet in the 60,073-square-foot building at 1610 Fifth St. in Berkeley, CA. The natural and organic food company signed a five-year deal and is scheduled to move in by the first quarter of this year. Annie’s will relocate from Napa.