A recent article in CNBC dwelt on the surge in foreclosure sales. Many of my buyers have been eagerly awaiting this surge (as have the REO agents!); we’ve been a bit disappointed in the East Bay however.

As we’ve discussed in prior posts, California and especially the inner Bay Area seems to be further ahead of most in moving through the housing crisis – this can be attributed to our rather speedy foreclosure process, a lack of overbuilding through the last decade and a job market that seems to be rebounding quickly.

If we keep our focus local, the trend is distinctly different than what you’ll hear on the national news. The following chart from Foreclosure Radar for Oakland shows how quickly our inventory of homes in foreclosure will be dropping:

The key number to watch is the preforeclosure rate, which represents the number of homes currently in default – down 32% from last year! While the number of homes in preforeclosure is dropping, many of those homes are already on the market in the form of short sales. Check out this chart on what happens to homes in the foreclosure process:

Investor activity, the “Sold to 3rd Party” remains strong. The number of cancellations has risen – this can be taken as a simple proxy for homes which were sold short or loans modified before an auction date. The number of homes which the banks have thus taken onto their books as an REO has dropped by 17%.

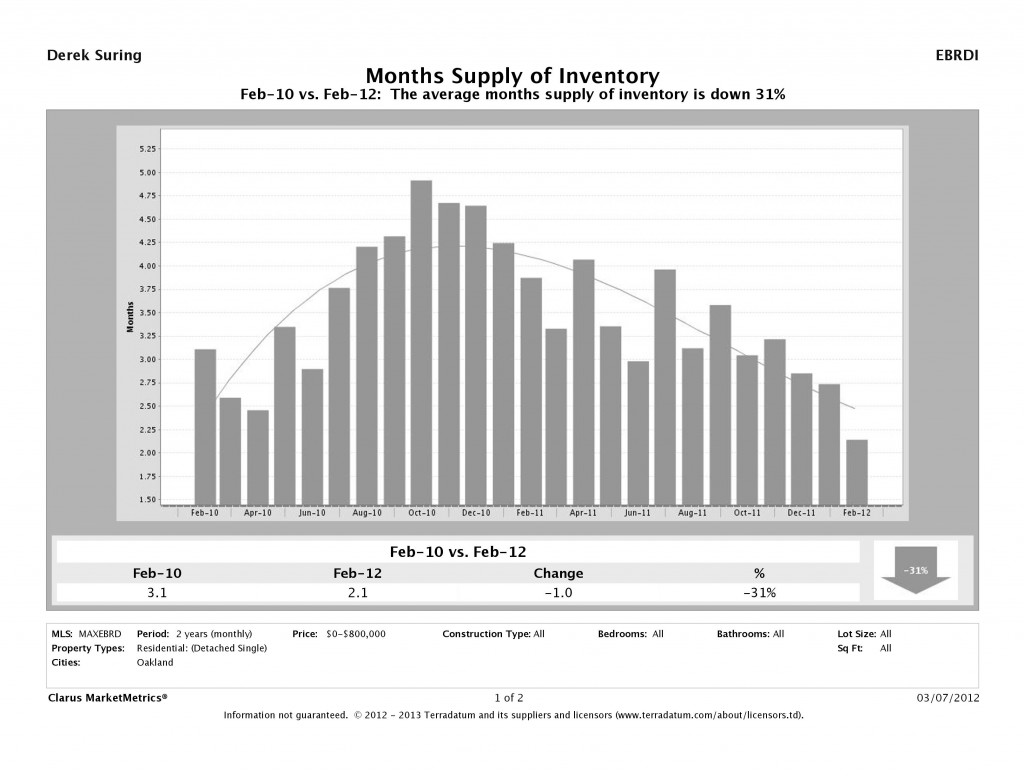

What does this drop in distressed properties mean for the market? It means the light at the end of the tunnel is certainly here, especially for homes priced in the non-luxury end of the market. If you’re trying to buy a home under $800k in Oakland, you have a lot less to choose from than you did a year ago; months supply of inventory is plummeting:

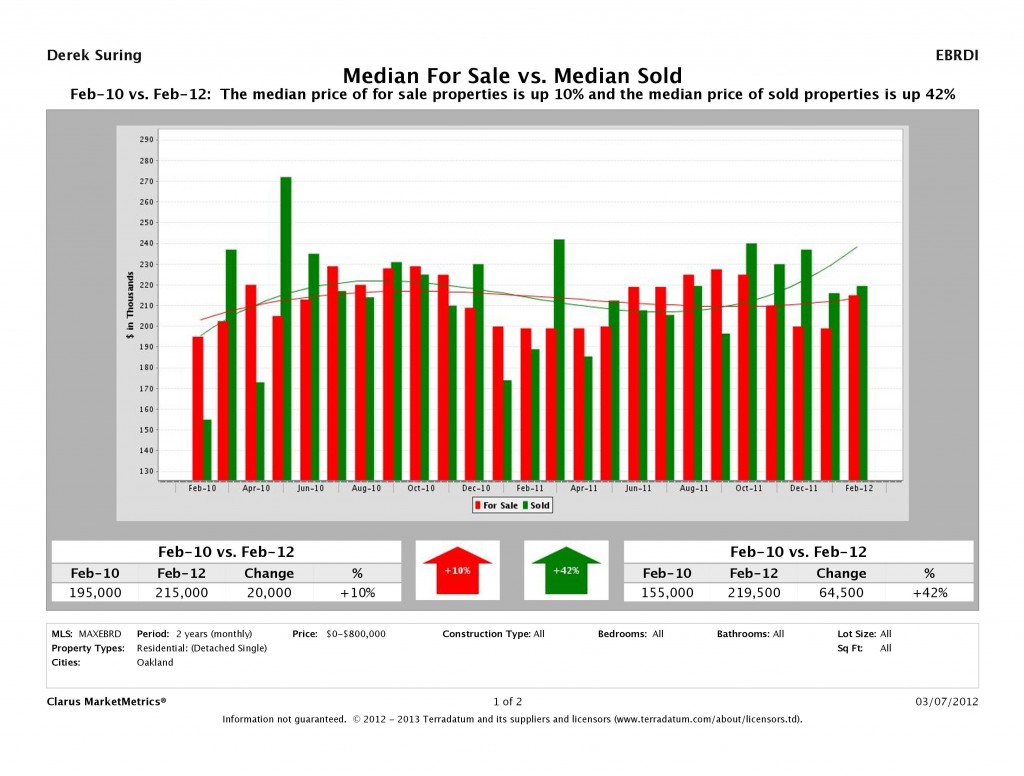

And we’re thus seeing more multiple offer situations and rising prices:

What does this mean for you? If you are looking to buy a house and were waiting for the floor – you are now standing firmly on it. As rents continue to rise we’ll see demand only increase for homes in the area as they still are more affordable than they have been in a decade. If you are considering selling you are starting to have more advantage than you’ve seen since the start of the crisis. That said, shoppers are still looking for bargains and we are currently trading at 2001 prices. As we see prices increase slightly more “normal” sales will come to the market, especially as Boomers who have been waiting to downsize for years realize that this market will not return to bubble highs for many years yet.

Four key indicators to watch moving forward:

- Lending Standards – These are loosening as default rates for new loans continue to remain at historical lows.

- Job Creation – As our local economy continues to improve, household formation will increase just as quickly as it collapsed in 2008.

- Interest Rates – As soon as these begin to turn up again, expect any increase in house prices to be negligible.

- Rents – We’ve seen year on year increases in Alameda County of 9%, even more in the South Bay and the Pennisula. As these continue, home buyers will be out in force.

As always, if you or anyone you know would like to discuss how this market affects their real estate decisions, we are available to help!

As we’ve all been closely following the recent settlement on the robo-signing crisis and attempting to divine the implications for our local markets; another development has been making waves of it’s own. As reported recently by Bloomberg News, JP Morgan Chase has begun offering homeowners up to $20k to complete a short sale of their homes. Wanting to dig a little deeper, I contacted my short sale insiders to learn more; it turns out that this is still an invite-only affair. Chase has begun mailing letters to mortgagees it has picked up through its recent acquisitions such as Washington Mutual.

This may just be a start, however. Bank of America, Wells Fargo and Citigroup are all doing trial runs of these programs themselves, typically in judicial foreclosure states where it takes more time to complete the process. Banks have slowly realized that they can pare their losses by 15% or more by allowing short sales to go through instead of foreclosing.

Thinking about selling your house and don’t want to wait for an invitation? We’ve recently been informed that Keep Your Home California has been dramatically under-utilized and still has funding. They provide up to $5,000 in relocation assistance in a successful short sale. Get in touch with us to learn more!

As most of my investors know, we’ve been watching the Marina Bay area with great interest for a few years. It’s a well designed condo project with plenty of well-regarded amenities and just so happens to be impossible to finance due to owner occupany rates and the fact that the developer still owns over 10% of the units. This restriction to cash-only buyers has pushed prices down to incredibly low levels; given the stable rents in the area this presents us with the opportunity to acquire low-maintenance rental property that will cash-flow well from day one.

We’ve also been telling all who will hear of the potential upside in the possible selection of the site immediately next door as the Berkeley’s Labs new second campus. Well, that day is here – please see the article from the NY Times below. This eventual two-million square foot campus is only a five minute walk down the bike path on the Richmond shore. Congratulations to those of you whom I’ve helped to purchase already. If you are considering the area I would suggest that the time to move is now – inventory is already thinning out and I expect it to become more competitive throughout that area as more investors realize the possibilities!

-Derek

Profitable Ripple Effect Projected for Berkeley Lab’s Second Campus in Richmond

By FRANCES DINKELSPIEL

Published: January 27, 2012

When the University of California, Berkeley, finishes a two-million-square-foot complex at the 120-acre Richmond Field Station, on university-owned land at the edge of San Francisco Bay, it will house more than 800 scientists doing research in bioscience, cancer, bioenergy and on the human genome.

But that may be just the first step in developing an even larger research center, said Robert Birgeneau, Berkeley’s chancellor. Mr. Birgeneau envisions a vibrant second campus with ample room to bring together University of California researchers and scientists from around the world.

“We are quite landlocked in the city of Berkeley, so each time another national project comes along, we are challenged where to place it,” he said. “Now we have new possibilities. Instead of exporting jobs, we will be importing jobs,” he said.

Richmond, which has a 17 percent jobless rate and a tax base that has declined by double digits in recent years, considers the second lab potentially transformative. Residents will be in a position to get some of the construction jobs. Developers are expected to construct buildings to accommodate spinoff businesses.

“This is the biggest thing we’ve had in terms of economic development,” said Bill Lindsay, the city manager.

The laboratory announced last year that it had outgrown its headquarters at Berkeley and was looking to build a second campus to unify its facilities, which are scattered around the East Bay. They include the Joint BioEnergy Institute in Emeryville, the Joint Genome Institute in Walnut Creek, the National Energy Research Scientific Computing Center in Oakland and the Berkeley West Biocenter.

Developers from eight cities gave 21 proposals, and the lab whittled those down to six final sites in May. Richmond beat out sites in Berkeley, Oakland, Emeryville and Alameda for the campus, widely regarded as one of the juiciest economic plums of the last few decades.

An environmental review of the site will begin soon. Lab officials hope to move in by 2016.

Richmond’s eagerness for the campus apparently played a role in its selection, according to A. Paul Alivisatos, the lab’s director, who pointed to “an outstanding show of community support.”

More than 700 residents attended the lab’s information night. The city put up a billboard along Interstate 580 that flashed “Richmond ♥ LBNL.” It printed buttons and postcards and had more than 500 residents write personal notes to lab employees inviting them to the city.

While neighboring cities that vied for the lab were disappointed, there are no hard feelings, said Michael Caplan, the City of Berkeley’s manager of economic development.

“What the lab has actually done is highlight the East Bay’s special position, particularly in bioscience, research and development, and the broader pipeline that exists,” Mr. Caplan said. “We’re happy for Richmond and we think it will be good for the whole East Bay.”

fdinkelspiel@gmail.com

Carolyn Said, Chronicle Staff Writer

Wednesday, January 25, 2012

“We are certainly seeing a lower level of foreclosure activity than a year or two ago,” said DataQuick President John Walsh. “The question is, how much of that decline is due to market conditions, and how much is due to policy changes that try to address economic distress?”

In the Bay Area, lenders filed 10,012 notices of default, the formal first step in the foreclosure process, in the final three months of the year, DataQuick said. That was down 16.6 percent from the same time in 2010. Statewide, 61,517 notices of default were filed, down 11.9 percent from the previous year.

The trend carried through to trustee’s deeds, the final step in the foreclosure process. In the Bay Area, a total of 4,831 trustee’s deeds were recorded in the fourth quarter, a 16.2 percent decline from 2010. In California, 31,260 trustee’s deeds were filed, an 11.8 percent decline.

The numbers are still high by historic standards, but are down compared with the rise in foreclosures four years ago.

As the housing market finds its footing and the economy adds jobs, the number of homeowners forced into foreclosure tends to drop.

“Once prices stabilize or start going up a little, fewer people get pushed into the distressed arena because there is a better chance that they will be able to refinance or sell the house and clear their loan,” said Andrew Le-Page, a DataQuick analyst. “Or they decide to fight to hang on. If prices were still going down, they might decide to throw in the towel.”

Lenders, which have come under ferocious criticism for not being more responsive to struggling homeowners, also have altered the way they handle late payments. Some of those changes stemmed from the 2010 robo-signing scandal that uncovered sloppy foreclosure paperwork.

“Five years ago, almost all mortgage payment delinquencies would have triggered a default notice after a certain amount of time,” Walsh said. “Strategies now include short sales, refinances, interest rate changes, principal reduction, as well as just plain waiting longer. It will be interesting to see how this plays out as the economy improves and the housing market finds its footing.”

Much of the housing distress remains concentrated in lower-cost inland areas where overbuilding was rampant during the housing boom. San Francisco, San Mateo and Marin remain the three California counties where mortgages are least likely to go into default, DataQuick said.

Across the Bay Area, there were 5.7 notices of default for every 1,000 homes in the fourth quarter. That concentration ranges from a low of 2.9 notices of default per 1,000 homes in San Francisco to a high of 10.7 such notices per 1,000 homes in Solano County. Statewide, the average was 7 notices of default per 1,000 homes.

For trustee’s deeds, the Bay Area had 2.7 per 1,000 homes, ranging from 1.2 per 1,000 homes in San Francisco to 6 in Solano. Statewide, there were 3.7 trustee’s deeds per 1,000 homes.

“We’ve worked through the worst of it,” LePage said.

E-mail Carolyn Said at csaid@sfchronicle.com.

Read more: http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2012/01/24/BU0U1MTTIP.DTL#ixzz1kVudasnm

By Eve Mitchell

Contra Costa Times

Rents are climbing sharply in the East Bay as people who were once homeowners look for places to rent after losing their homes to foreclosure or not being able to keep up with their mortgage payments.

Rents are rising even faster in Santa Clara and San Mateo counties as tech-driven employment continues to create increased demand for apartments, said a report to be released Thursday by RealFacts.com.

Both areas saw rents return to their pre-recession highs.

“In the Santa Clara and San Mateo area, given the importance of the technology industry, the rate is growing, there is more demand, and vacancy rates are especially low in Santa Clara County. … That creates pressure on the rental market,” said Jed Kolko, chief economist for San Francisco-based Trulia.com, a website for home sales and apartment rentals.

“But even in places where the economy isn’t doing as well, we are still seeing increases in rent because homeownership has gone down. And that means that more people are in the rental market,” he said.

The rankings are based on asking rents for all types of apartments ranging from studios to three-bedrooms in large complexes that have 50 or more apartments.

The report also listed the Bay Area, which RealFacts defines as Alameda, Contra Costa, Marin, San Francisco and San Mateo counties, as showing the biggest quarter-to-quarter gains in rents among 47 metro areas nationwide. The region’s average rent of $1,697 was up 3.3 percent from the second quarter and 9.7 percent higher than a year ago.

But while the Bay Area tops the list on a quarter-to-quarter basis, Santa Clara is the leader on a year-to-year basis.

“The Bay Area definitely outperforms all other markets, and if you look at Santa Clara County year-over-year it’s approaching 13 percent, which is unprecedented growth for what’s happening overall in our economy,” said Sarah Bridge, owner of RealFacts.

In Santa Clara County, the average rent for an apartment in the three-month period ending in September was $1,792, up 1.8 percent from the previous quarter and 12.9 percent higher than a year ago. San Mateo County had an average rent of $1,866, up 2.8 percent from the previous quarter and 10.7 percent higher from a year ago.

In Alameda County, the average rent was $1,490, up 1.8 percent from the previous quarter and 8.7 percent higher than a year ago. In Contra Costa County, the average rent was $1,342, up 2.8 percent from the previous quarter and 7 percent higher from a year.

In all four counties, rents were higher than they were in 2007. The recession arrived in December that year and officially ended in June 2009.

Many cities in the Bay Area showed double-digit rent increases compared with a year ago, the report said.

The highest year-to-year percentage increase in the region was in Cupertino, where rents rose 17.9 percent to $2,249, followed by Mountain View, where rents climbed 16.3 percent to $1,876. Rents rose 13.8 percent to $1,979 in San Mateo, and 12.4 percent to $2,083 in Foster City.

In the East Bay, the city that had the biggest year-to-year percentage increase was Newark, where the average rent increased 13.7 percent to $1,547, followed by Pleasanton, where rents rose 13.3 percent to $1,748. Rents climbed 11.3 percent to $1,415 in Pleasant Hill, followed by Walnut Creek, where rents rose 11.1 percent to $1,551.

Thanks to Calculated Risk for this update!

Reis reported that the apartment vacancy rate (82 markets) fell to 5.6% in Q3 from 6.0% in Q2. The vacancy rate was at 7.1% in Q2 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Landlords Push Up Apartment Rents

The vacancy rate for the third quarter, which wraps up the prime leasing season, fell to 5.6% from 7.1% a year earlier. That is the lowest since 2006.

The increased demand follows several years that saw little new apartment development. About 8,200 units came online during the third quarter, one of the lowest quarterly figures since Reis began tracking the data in 1999.

…

Average effective apartment rents, the amount paid after discounting, rose to $1,004 nationwide in the third quarter, up 2.4% from a year earlier … In the third quarter, 36,000 net units were filled, down from 42,000 in the second quarter.

This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

A few key points we’ve been discussing:

• Apartment vacancy rates are falling fast.

• A record low number of multi-family units will be completed this year (2011). Only 8,200 apartments came on the market in Q3 (in the Reis survey area).

• Multi-family starts are increasing, and that is helping both GDP and employment growth this year. These new starts will not be completed until 2012 or 2013, so vacancy rates will probably continue to decline.

by KERRI PANCHUK

The 30-year, fixed-rate mortgage hit lows not seen in five decades this week as the Federal Reserve committed to keeping the federal funds rate low through 2013, according to the Freddie Mac Primary Mortgage Market Survey.European debt concerns also riled the market, staving off a hike in mortgage rates, according to Frank Nothaft, vice president and chief economist for Freddie Mac.The 30-year, fixed-rate mortgage dropped to 4.15% from 4.32% a week earlier and 4.42% last year. Nothaft said 30-year, fixed mortgage rates are at their lowest levels in five decades.Meanwhile, the 15-year, FRM hit 3.36%, down from 3.50% a week earlier and 3.90% last year. In addition, the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.08% this week, down from 3.13% a week earlier and 3.56% a year ago, while the one-year Treasury-indexed ARM averaged 2.86%, down from 2.89% last week and 3.53% last year.The low rates kept refinancing activity high. In the first half of 2011, refinancing applications represented nearly 70% of all mortgage activity.Bankrate attributes the record low interest rates to “weakness in the U.S. economy and the accompanying demand for Treasury securities.”According to Bankrates survey, the 30-year, FRM hit 4.45%, down from 4.46% last week, while the 15-year, FRM hit 3.58%, down from 3.61% a week earlier.The 5/1 ARM fell to 3.15% from 3.24% a week earlier.

via Fixed mortgage rates hit 50-year lows: Freddie Mac « HousingWire.

1524 Hampel Street,

1524 Hampel Street,

Oakland

Uber Cute bungalow blocks from Park Blvd. Gorgeous details, lovely light, stunning bay window, fireplace and built-ins. Two bedrooms, one bath offered at $529k.

By Lew Sichelman

July 10, 2011

Reporting from Washington—

Who is going to lead the housing market out of the doldrums?Certainly it wont be move-up buyers. People who already own homes are not likely to be venturing forth to find another one until they can sell their current residences. And with all those foreclosures gumming up the works, its tough to stand out in the crowd unless youre willing to give your place away.

It probably wont be first-time buyers, either. Despite the most affordable prices and loan rates in ages, rookies have shown a marked propensity to remain on the sidelines. After all, why rush? Who wants to buy a house, only to see its value go down? Why not wait until we know values have hit bottom?

That leaves investors. According to a new survey from the California outfit that operates the official website of the National Assn. of Realtors, real estate investors will outnumber traditional borrowers 3 to 1 over the next two years.Investors are sometimes thought of as bottom feeders who pick off properties from financially troubled sellers who see no other way out. And while there most likely will be a bit of that going forward, this time around the main prey will be banks, not strapped consumers.Thats a good thing. The overwhelming consensus is that before the sinking housing market can right itself, banks must rid themselves of millions of houses and apartments theyve already taken back or will repossess in the future. Get them off their books and into the hands of users. Only after houses under duress are cleared from the decks will housing find its footing.

Investors often are in and out in a flash, buying a place, splashing some paint on the walls, maybe updating the appliances and then reselling at a good, if not huge, profit. Again, while there will be some “flipping” in the future, the survey by Move Inc. found that most investors will buy and hold for at least five years, long enough for many neighborhoods to stabilize.

Moreover, nearly half say they plan to invest their own time and energy to repair, maintain and improve their properties. And 30% say theyll hire a contractor to do the work.

These would-be investors still expect to reap decent returns. Nearly half of the 200 investors queried — a statistically relevant sample — expect to make a profit of 20% or more when they sell after their five-year or longer hold. In the meantime, most will put their investments to work as rentals. Some may even live in their properties until they jettison them sometime down the road.

In other words, says Move Chief Executive Steve Berkowitz, todays investors, many of whom are new to real estate, are not your stereotypical deal-driven sharks. Rather, he says, they are mostly entrepreneurial individuals who “will make vital contributions to local communities by investing their own money and sweat equity [that] over the long run will help improve housing stocks, home values and property tax bases in thousands of local communities.”

Lets hope so.

lsichelman@aol.com

via Real estate investors: Investors to the rescue of housing market – latimes.com.