A recent article in CNBC dwelt on the surge in foreclosure sales. Many of my buyers have been eagerly awaiting this surge (as have the REO agents!); we’ve been a bit disappointed in the East Bay however.

As we’ve discussed in prior posts, California and especially the inner Bay Area seems to be further ahead of most in moving through the housing crisis – this can be attributed to our rather speedy foreclosure process, a lack of overbuilding through the last decade and a job market that seems to be rebounding quickly.

If we keep our focus local, the trend is distinctly different than what you’ll hear on the national news. The following chart from Foreclosure Radar for Oakland shows how quickly our inventory of homes in foreclosure will be dropping:

The key number to watch is the preforeclosure rate, which represents the number of homes currently in default – down 32% from last year! While the number of homes in preforeclosure is dropping, many of those homes are already on the market in the form of short sales. Check out this chart on what happens to homes in the foreclosure process:

Investor activity, the “Sold to 3rd Party” remains strong. The number of cancellations has risen – this can be taken as a simple proxy for homes which were sold short or loans modified before an auction date. The number of homes which the banks have thus taken onto their books as an REO has dropped by 17%.

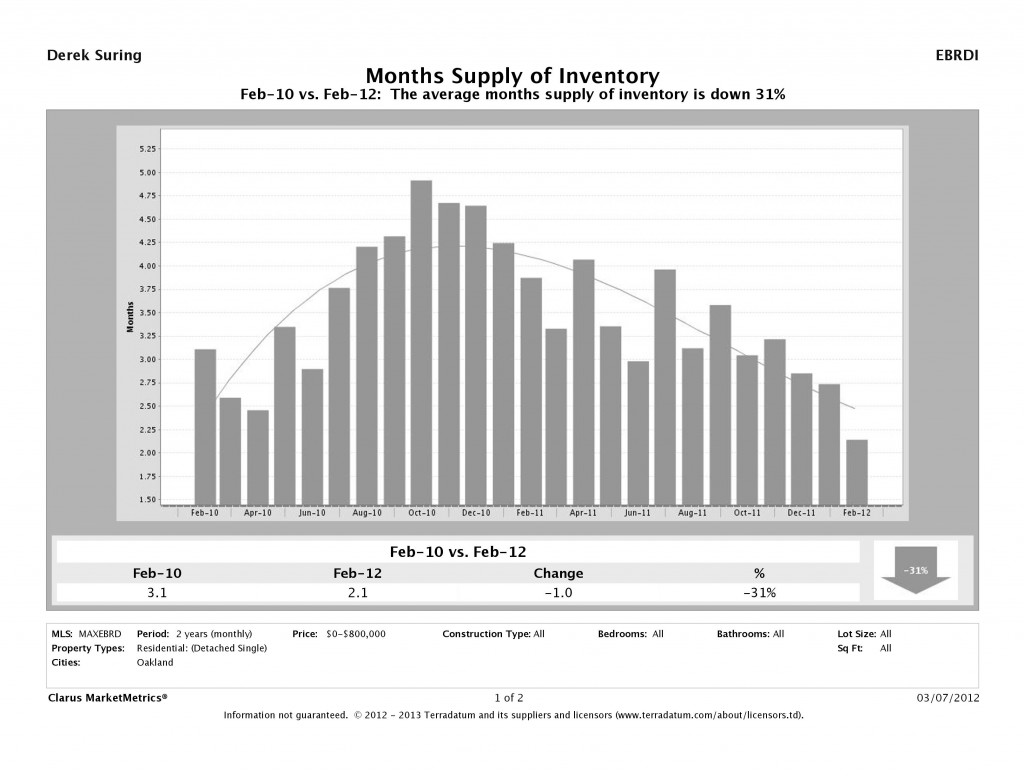

What does this drop in distressed properties mean for the market? It means the light at the end of the tunnel is certainly here, especially for homes priced in the non-luxury end of the market. If you’re trying to buy a home under $800k in Oakland, you have a lot less to choose from than you did a year ago; months supply of inventory is plummeting:

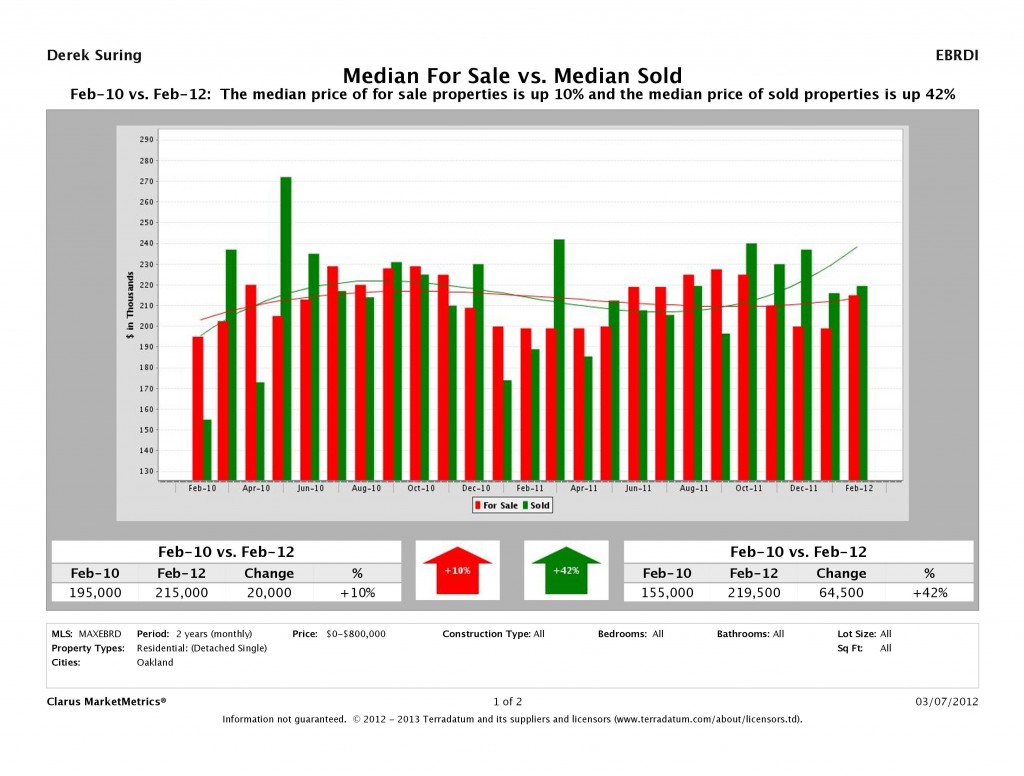

And we’re thus seeing more multiple offer situations and rising prices:

What does this mean for you? If you are looking to buy a house and were waiting for the floor – you are now standing firmly on it. As rents continue to rise we’ll see demand only increase for homes in the area as they still are more affordable than they have been in a decade. If you are considering selling you are starting to have more advantage than you’ve seen since the start of the crisis. That said, shoppers are still looking for bargains and we are currently trading at 2001 prices. As we see prices increase slightly more “normal” sales will come to the market, especially as Boomers who have been waiting to downsize for years realize that this market will not return to bubble highs for many years yet.

Four key indicators to watch moving forward:

- Lending Standards – These are loosening as default rates for new loans continue to remain at historical lows.

- Job Creation – As our local economy continues to improve, household formation will increase just as quickly as it collapsed in 2008.

- Interest Rates – As soon as these begin to turn up again, expect any increase in house prices to be negligible.

- Rents – We’ve seen year on year increases in Alameda County of 9%, even more in the South Bay and the Pennisula. As these continue, home buyers will be out in force.

As always, if you or anyone you know would like to discuss how this market affects their real estate decisions, we are available to help!